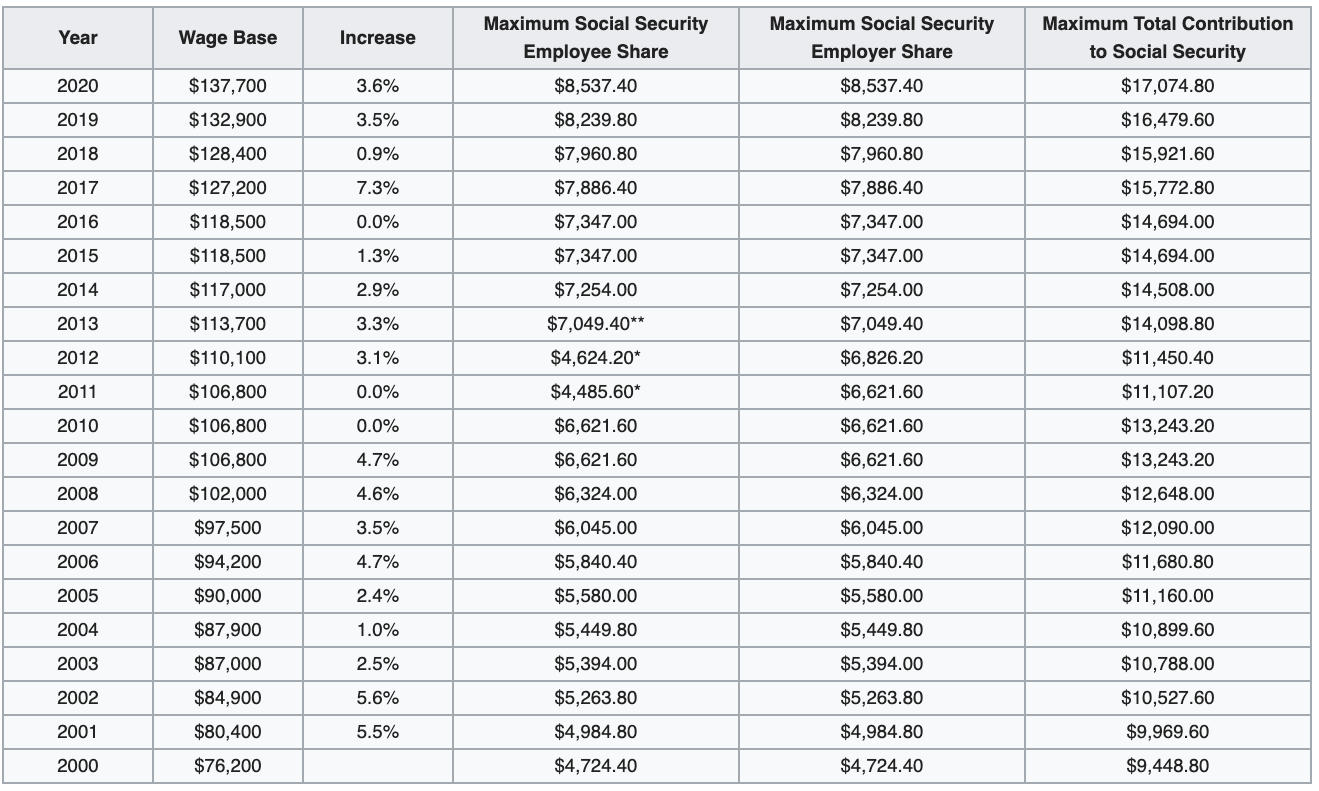

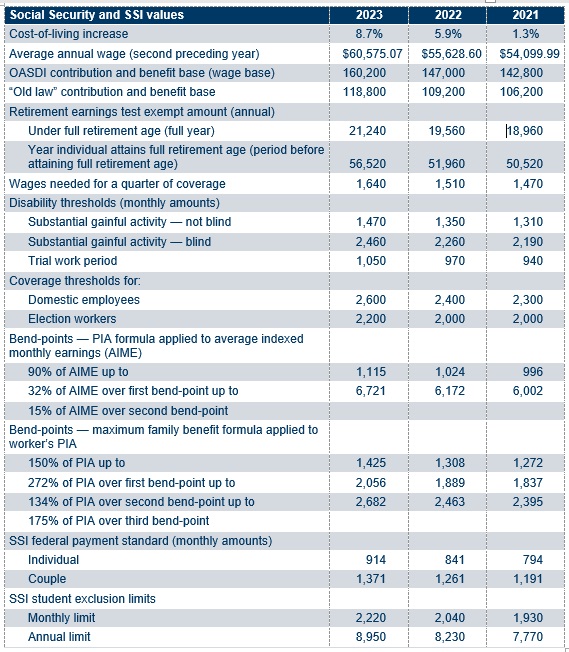

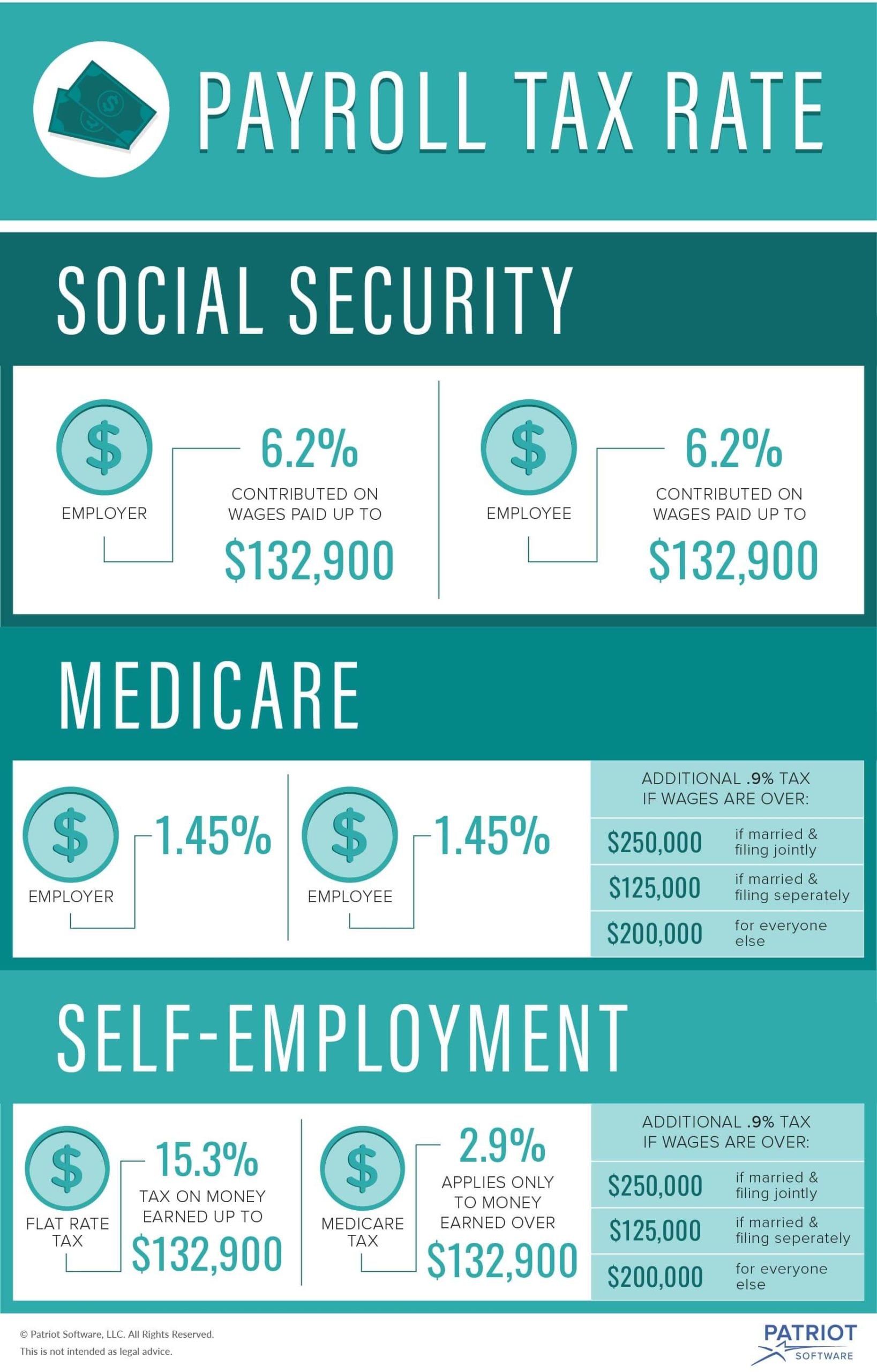

2025 Social Security Withholding Rates - Max Social Security Benefit 2025 Gabey Marilee, Of course, both employers and employees pay the 6.2% social. The 2025 employer withholding rates are as follows: What are the federal income tax rates for 2025?

Max Social Security Benefit 2025 Gabey Marilee, Of course, both employers and employees pay the 6.2% social.

Social Security Max 2025 Deduction Bobby Christa, Of course, both employers and employees pay the 6.2% social.

2025 Social Security Withholding Rates. Thus, an individual with wages equal to or larger than $168,600. What is the social security withholding rate for employees in 2025?

What Is Max Social Security Withholding 2025 Nerta Yolanda, The social security withholding rate is 6.2% for employees in 2025.

Maximum Social Security Tax Withholding 2025 Table Dulci Glennie, What is the social security withholding rate for employees in 2025?

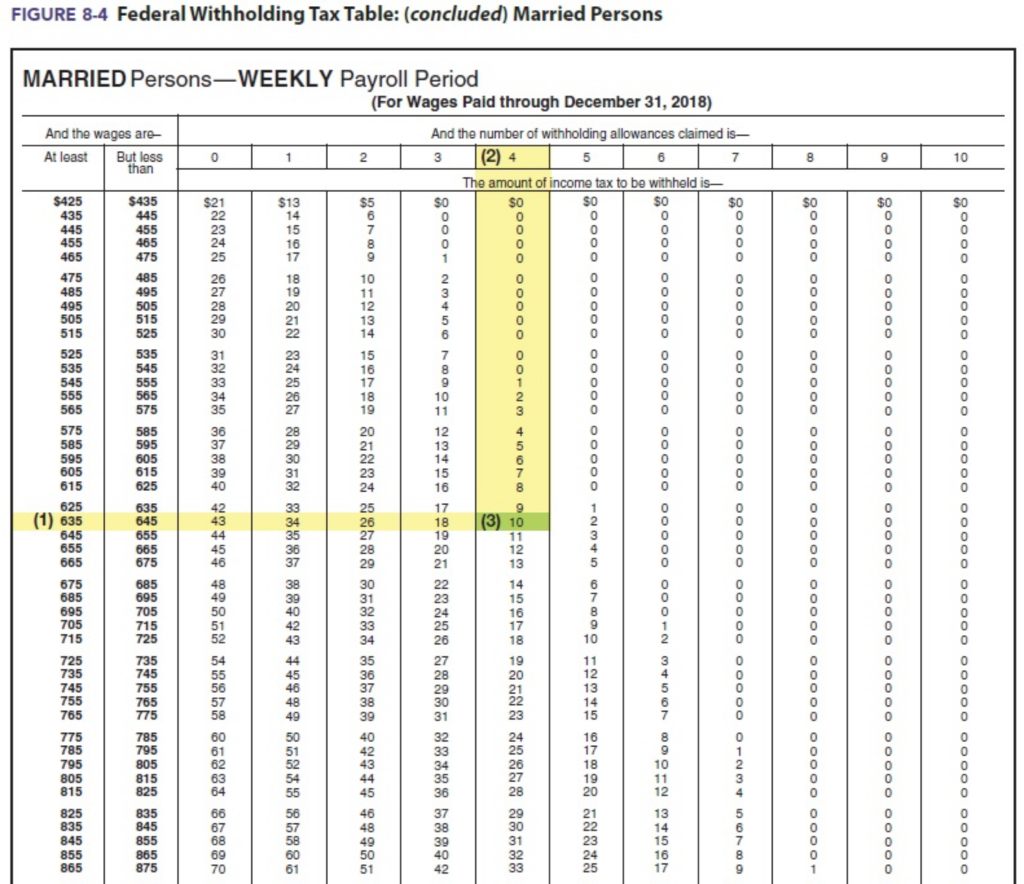

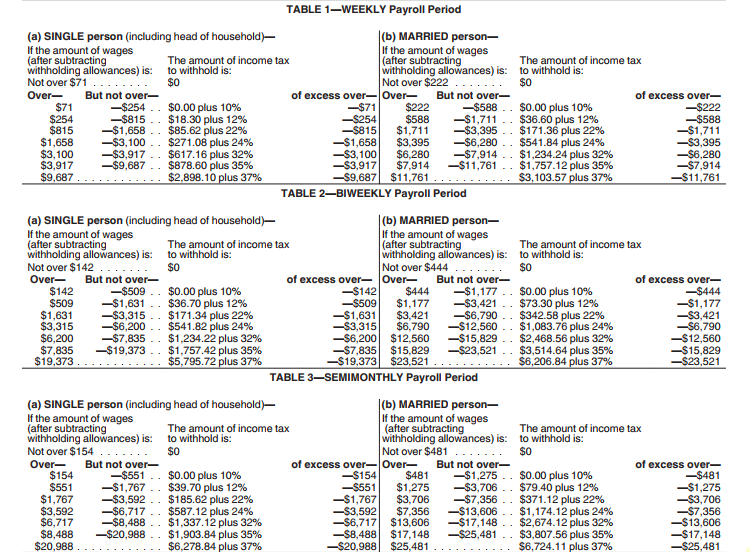

Maximum Social Security Tax 2025 Withholding Tax Elane Xylina, The federal withholding tax rates from the irs for 2025 are 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Social Security 2025 Limit Allyn Lorilee, What are the federal income tax rates for 2025?

Social Security Tax Limit 2025 Withholding Table Adora Ardelia, Thus, an individual with wages equal to or larger than $168,600.

Social Security Limit 2025 Withholding Bel Rosemary, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

2025 Max Social Security Tax Withholding Table Dode Nadean, 6.2% social security tax on the first $168,600 of employee wages (maximum tax is $10,453.2) 1.45% medicare tax on all.